geothermal tax credit extension

However any credit amount in excess of the tax due can be carried over for up to. The tax credit for geothermal was also increased from 10 to 15 and ocean thermal equipment was added as qualifying property.

What Is The 2021 Geothermal Tax Credit Climatemaster Geothermal Hvac

Sign Up for Email Updates.

. The credit has been extended many times and as of December 2021 if you make energy-efficient home improvements before Jan. To claim a foreign tax credit you may need to file Form 1116 along with Schedule 3 and your 1040 tax return. Calculation of Estimated PIT Underpayment Penalty Form.

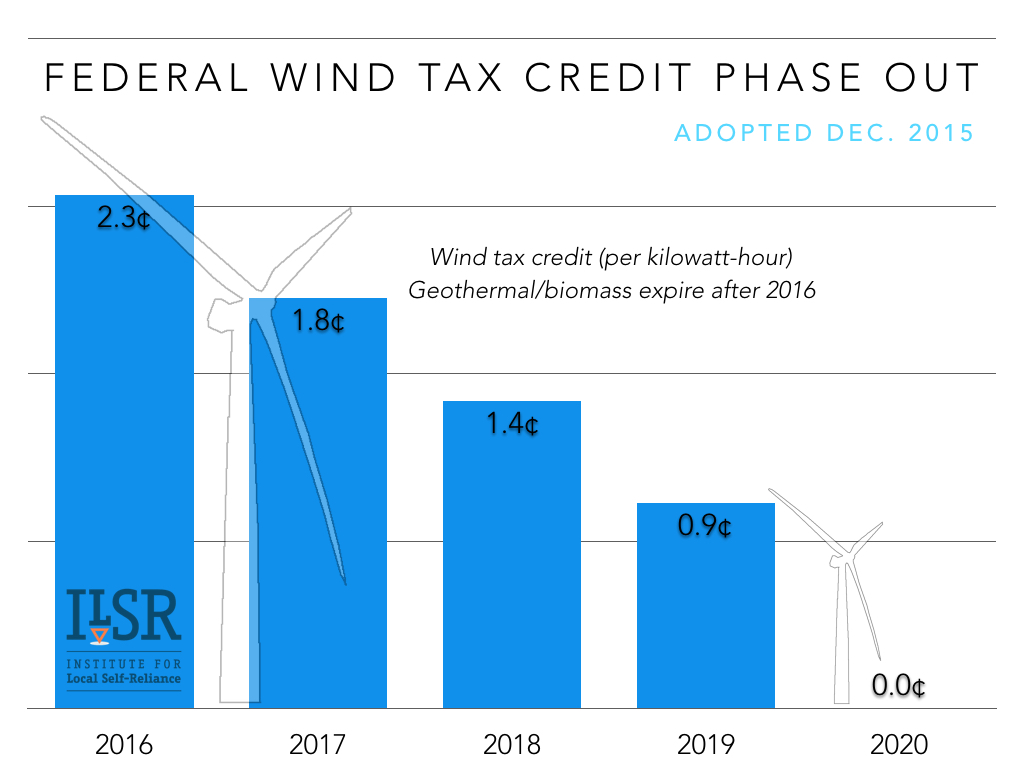

The amount of credit you receive is based on your income and the number of qualifying children you are claiming. Tax Credits Rebates. At the end of December 2020 Congress extended the PTC at 60 of the full credit amount or 0018 per kWh 18 per megawatthour for another year through.

The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. This Act made new geothermal plants eligible for the full federal production tax credit previously available only to wind power projects and certain kinds of biomass. MD-502E - Maryland Application For Extension To File Personal Income Tax Return MD-502INJ - Injured Spouse Claim Form MD-502SU - Maryland Subtractions From Income MD-500CR - Maryland Business Income Tax Credits MD-588 - Direct Deposit Of Maryland Income Tax Refund To More Than One Account MD-El101 - Maryland E-File Declaration For Electronic Filing MD.

If you paid tax to a foreign country or US. Go to the Help menu in your tax year 2020 software and select Download. Since the Geothermal Tax Credit is non-refundable you would not receive a refund if your credit exceeds your tax bill.

The solar energy system equipment credit is not refundable. Weve been hard at work making Intuit ProSeries Tax even easier to use so you can save time on every return. 1424 offers a onetime tax credit of 30 of the total investment for homeowners who install residential ground loop or ground water geothermal heat pumps that meet or exceed ENERGY.

The 10 credit for biomass was also extended for three years through 1985. Solar wind geothermal and fuel cell technology are all eligible for the residential energy efficient property credit. As of 2021 biomass fuel stoves are included in tax.

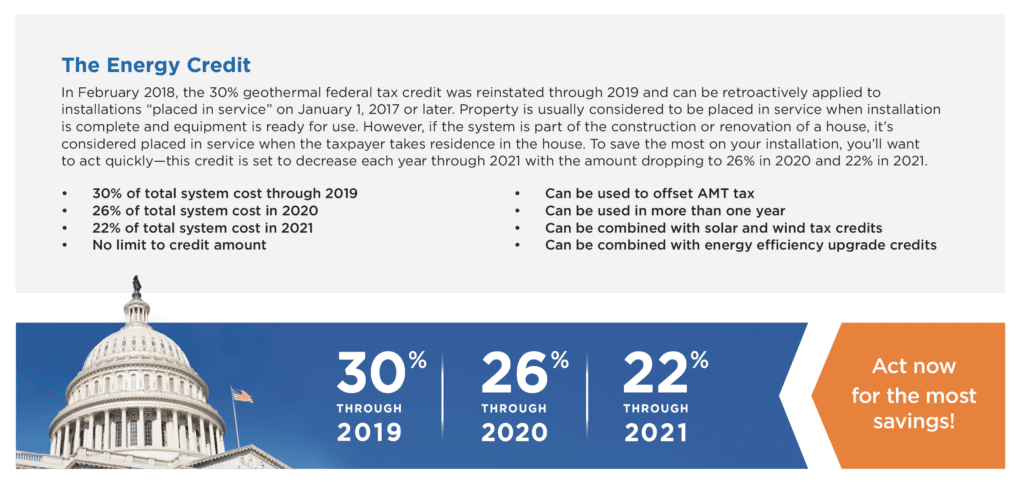

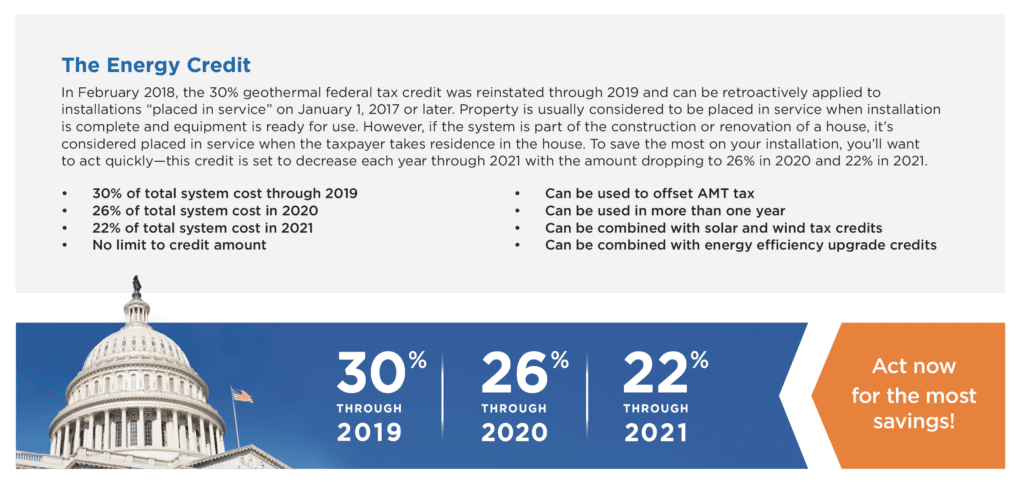

It will drop to 22 in 2023 and expire at the end of 2023. There is no upper limit on the amount of the credit for solar wind and geothermal equipment. The 2008 economic stimulus bill Emergency Economic Stabilization Act of 2008 included an eight-year extension through 2016 of the 30 percent investment tax credit with no upper limit to all home installations of EnergyStar certified geothermal heat pumps.

The nonbusiness energy property credit expired on December 31 2017 but was. It also authorized and directed increased funding for research by the Department of Energy and enabled the Bureau of Land Management to address its backlog of geothermal leases and permits. Systems installed before December 31 2019 were eligible for a 30 tax credit The tax credit expires starting in 2024 unless Congress renews it.

They and other incentives that select lawmakers look to pass in. As long as the credit is active you can continue to apply your credit balance to your tax bill. After that the percentage steps down and then stops at the end of.

The tax credits for residential renewable energy products are now available through December 31 2023. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. 1 2024 you are eligible to reduce the amount of taxes you owe.

The IRS pre-paid half the total credit. The ITC is generated at the time the. Geothermal tax credits are also available for home owners who install geothermal heating and cooling systems through the Energy Improvement and Extension Act of 2008 HR.

Please visit the Database of State Incentives for Renewables Efficiency website DSIRE for the latest state and federal incentives and rebates. The Consolidated Appropriations Act 2018 extended the credit through December 2017. Extension of these home-energy tax credits beyond their 2023 expiration remains up in the air.

Geothermal Ground-Coupled Heat Pump Tax Credit. The maximum tax credit for fuel cells is 500 for each half-kilowatt of power capacity or 1000 for each kilowatt. By claiming the Child Tax Credit CTC you can reduce the amount of money you owe on your federal taxes.

Installing alternative energy equipment in your home such as solar panels and geothermal heat pumps can qualify you for a credit equal to 30 of your total cost. Renewable energy tax credits for fuel cells small wind turbines and geothermal heat pumps now feature a gradual step down in the credit value the same as those for solar energy systems. Download Print e-File with TurboTax.

There is a 10 credit for geothermal microturbines 2 MW and combined heat and power plants 50 MW. Download Print e-File with TurboTax. For full details on each new feature click here.

In December 2020 Congress passed an extension of the ITC which provides a 26 tax credit for systems installed in 2020-2022 and 22 for systems installed in 2023. Solar fuel cells 150005 kW and small wind 100 kW are eligible for credit of 30 of the cost of development with no maximum credit limit. Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021.

IV Mii amended subsec. For example a fuel cell with a 5 kW capacity would qualify for 5 x 1000. 3 Credit reduced for grants tax-exempt bonds subsidized energy financing and other credits The amount of the credit determined under subsection a with respect to any project for any taxable year determined after the application of paragraphs 1 and 2 shall be reduced by the amount which is the product of the amount so determined for such year and the lesser of ½ or.

Possession and are subject to US. Facebook Twitter Youtube Instagram Linkedin. The full credit is available through the end of 2019.

For example if your credit amounts to 8000 in 2021 but your liability. The tax credit today The Consolidated Appropriations Act 2021 extended the 26 tax credit through 2022. Whats new in ProSeries Tax 2021.

Fortunately this incentive allows the homeowner to utilize their credit balance over multiple years. The definition of biomass included materials such as municipal solid waste. Returning ProSeries Professional and ProSeries Basic customers.

The residential energy property credit which expired at the end of December 2014 was extended for two years through December 2016 by the Protecting Americans from Tax Hikes Act of 2015. N generally to reflect the renaming of an investment tax credit ESOP to a tax credit employee stock ownership plan and a leveraged employee stock ownership plan commonly referred to as an ESOP to an employee. The act also provided an 11 credit for small-scale hydroelectric.

The credit is equal to 25 of your qualified solar energy system equipment expenditures and is limited to 5000. If youre using. File an IRS extension Back Back Back Back After you file Back Track your.

SW Washington DC 20585 202-586-5000. Production tax credit PTC a per-kilowatthour kWh credit for electricity generated by eligible renewable sources was first enacted in 1992 and has been extended and modified in the years since. Geothermal Wind Water Transportation Transportation.

Equipment used to produce distribute or use energy derived from a geothermal deposit within the meaning of. This investment tax credit varies depending on the type of renewable energy project. File an IRS extension Back Back Back Back After you file Back Track your refund Explore Track.

Download Print e-File with TurboTax. Tax on the same income you may be able to take the foreign tax credit to reduce your domestic tax liability. 2020 Military Spouse Withholding Tax Exemption Statement.

Geothermal Investment Tax Credit Extended Through 2023

Congress Gets Renewable Tax Credit Extension Right

Understanding The Geothermal Tax Credit Extension

.png)

Congress Gets Renewable Tax Credit Extension Right

Geothermal Tax Credit Extended Colorado Country Life Magazine

Tax Credits And Other Incentives For Geothermal Systems Waterfurnace

What Federal Tax Incentives Are There For Geothermal Heat Pumps

The Federal Geothermal Tax Credit Your Questions Answered

What Is The 2021 Geothermal Tax Credit Climatemaster Geothermal Hvac